The 9-Second Trick For Business Capital

Table of ContentsIndicators on Business Capital You Should KnowHow Business Capital can Save You Time, Stress, and Money.Business Capital for BeginnersIndicators on Business Capital You Should KnowExamine This Report about Business CapitalBusiness Capital - Truths

Financial obligation capital is cash that has been borrowed to help sustain an organization' capital framework. This money may be obtained over either short term or longer term durations. How a lot it costs the firm is dictated by their practicality; if they're highly ranked and also able to borrow with reduced rates, it looks far better for a firm than if their danger determines a higher portion price on what they obtain.The different parts of financial obligation in capital framework consist of: Senior Financial obligation: If a firm faces economic problem or filed for personal bankruptcy, financing under this category obtains paid back first. Elderly financial debt loans have a tendency to have a reduced rate of interest. Subordinated Debt: These fundings aren't as danger cost-free as elderly financial debt lendings, but their higher rate of interest indicate loan providers can make their cash back and after that some.

Business Capital Fundamentals Explained

It might not be the easiest way to build business funding structure, which is why car loans or little organization funds can be a much less complicated optionalthough the application process may be much more entailed, needing an organization plan and a rundown of costs. This debt is a local business's desire become a reality since it only pays rate of interest, as well as the principal does not need to be repaid for a long time.

Companies may resort to this kind of financial obligation to cover any costs owed to suppliers, marketing off goods to develop their service while satisfying financial companions. Insurer depend on this kind of financial debt to cover expenses as needed or rest in an account and also make interest till the financial obligation requires to be paid off.

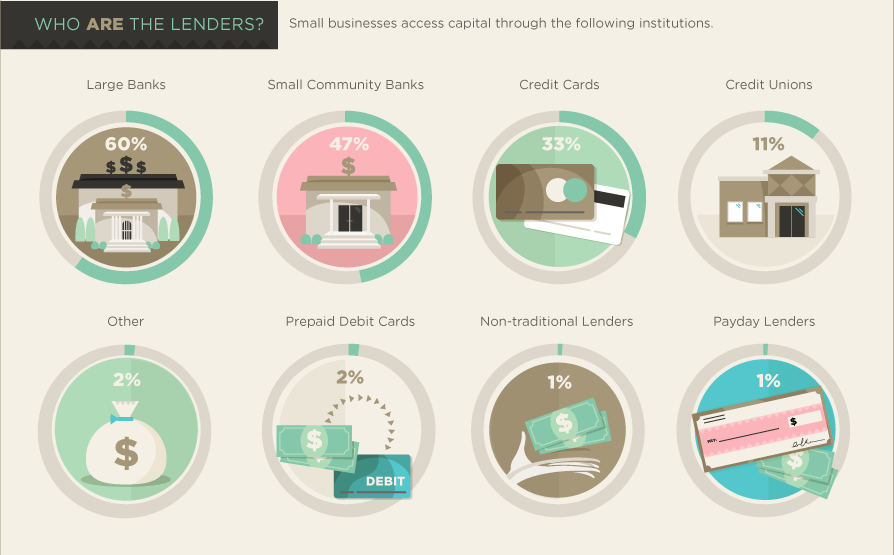

Whether you are beginning a business, or scaling up an existing one, the significance of having sufficient resources can not be overstated. Practically every entrepreneur has actually utilized bootstrapping or little service financings at some point in their careers.

Business Capital Fundamentals Explained

This commonly enables you to expand your company far more quickly. The disadvantage, however, with funding is that you go from having full ownership of your company to having part ownership. Your new financiers may intend to have input on the direction of business, and you will be answerable to meet the timelines of your investors.

This will differ depending on your business. As well as then there are the prices of working capital to think about.

We would certainly be delighted to review your choices with you as well as More Help help you discover an option that suits your business.

4 Easy Facts About Business Capital Shown

Capital is a prevalent statistics for the effectiveness, liquidity and also general health and wellness of a company. It is a representation of the results of different company tasks, including profits collection, financial obligation management, supply administration and repayments to vendors. This is because it includes stock, accounts payable and also receivable, cash money, portions of financial obligation due within the duration of a year and other temporary accounts.

Capital can also stand for the gathered riches in a service, or the proprietor's investment in a service. Basically, it's just how much business owner has at any kind of one point. How the company proprietor's resources account is structured about his depends upon the kind you can try these out of business. A sole owner has 100% ownership in business.

Business Capital for Dummies

The person makes a funding contribution to the organization when they sign up with, investing in the business.

It's possible for an organization to have one more business. A corporation may be a part-owner of an LLC. In this instance, the capital account may not be merely a one-person account.

This funding account is included to or deducted from for the adhering to events: The account is increased by owner contributions. These might be preliminary contributions when signing up with the firm, or later financial investments as needed or chosen upon by the owners.

The Of Business Capital

The account is likewise subtracted from for any kind of distributionstaken by the proprietor for his/her personal use. For example, allow's claim two people sign up with to develop an LLC. Each puts in $50,000, so each capital account starts with $50,000. They are likewise 50% owners and they consent to distribute profits and also losses using this percent.

During the year, each owner took cash out of the service for personal use. When you begin an organization, you will certainly practically certainly have to place in money to get it going.